Overview: From January to June, the prices of iron ore, coking coal, billet, strip steel, steel pipe and other bulk commodities all fluctuated greatly. Although various loose and prudent monetary policies promoted the overall improvement of domestic economic operation this year, the construction industry recovered slowly this year. In addition, the external environment is still complicated and severe, the spillover effect of policy withdrawal in major economies increased, and there are many constraints on the release of domestic demand. The overall supply and demand relationship of steel varieties this year is basically in a pattern of “strong expectation and weak reality”. As an essential welded pipe variety in the construction industry, this paper will briefly analyze the operation of welded pipes in China in recent months.

Ⅰ. The price of welded pipes dropped sharply year-on-year

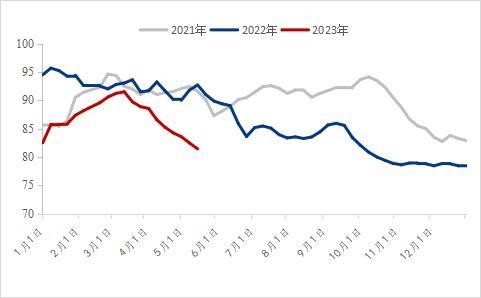

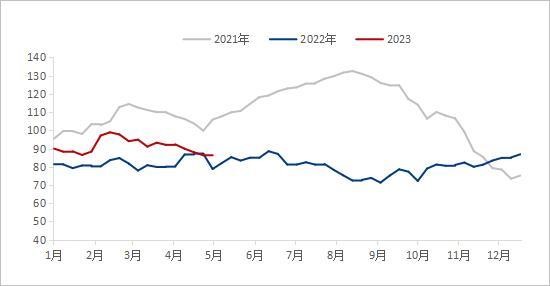

Judging from the national welded pipe price in recent four years, the starting point of welded pipe price at the beginning of 2023 is obviously lower than that of the same period last year. On January 2, 2023, the national average price of welded pipes was 4,492 yuan/ton, down 677 yuan/ton year-on-year; As of June 7, 2023, the average price of welded pipes in 2023 was 4,153 yuan/ton, down 1,059 yuan/ton or 20.32% year-on-year.

Since 2021, commodity prices have continued to run at a high level, PPI in major economies has hit record highs, and higher prices of upstream products have continued to be transmitted to the middle and lower reaches. Since June 2022, with the continuous low demand for finished products, the prices of raw materials at home and abroad have dropped sharply, and the average price of steel pipes has also started to move down significantly. After several waves of rapid declines in raw material prices, the price of welded pipes this year is significantly lower than that of the same period last year. In the first quarter, under the better macro expectation, the downstream demand marginal improved, and the national welded pipe price rose slightly. However, with the failure of the traditional peak season demand, the prices of raw materials and finished products began to fall, but the price decline did not increase the actual demand. In June, the national welded pipe price was already at a low level in recent years.

Ⅱ. The national social inventory of welded pipes is low year-on-year

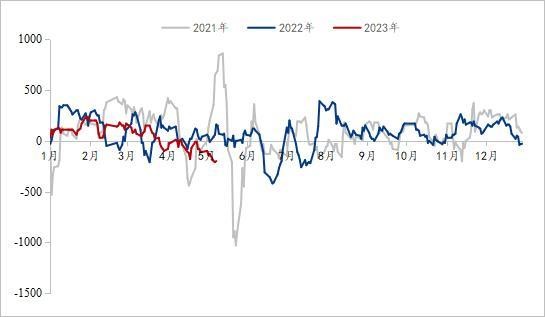

Affected by the large fluctuation and rapid change of welded pipe price in the previous two years, many traders chose more stable management methods this year. In order to reduce the pressure brought by inventory backlog, inventory was mostly kept at a medium and low level. After the price of welded pipes fluctuated and fell in March, the social inventory of welded pipes in China decreased rapidly. As of June 2, the national social inventory of welded pipes was 820,400 tons, an increase of 0.47% month-on-month and a decrease of 10.61% year-on-year, which has reached a low inventory level in recent three years. Recently, most traders have less inventory pressure.

Figure 2: Social Inventory of Welded Pipe (Unit: 10,000 tons)

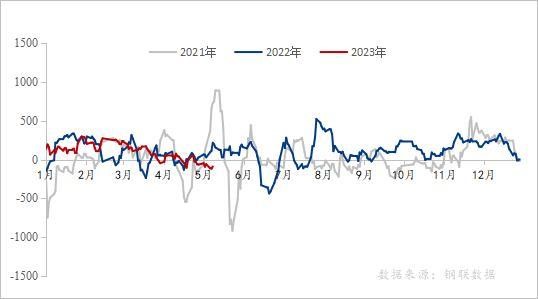

Ⅲ. The profit of welded pipe is at a low level in the past three years

From the perspective of profit margin of welded pipe industry, the profit of welded pipe industry fluctuates greatly this year, which can be divided into the following stages. As of May 10, 2023, the average daily profit of welded pipe industry from January to March was 105 yuan/ton, a year-on-year decrease of 39 yuan/ton; From January to March, the average daily industry profit of galvanized pipes was 157 yuan/ton, an increase of 28 yuan/ton year-on-year; From April to May, the average daily industry profit of welded pipe was-82 yuan/ton, a year-on-year decrease of 126 yuan/ton; From April to May, the average daily industry profit of galvanized pipes was-20 yuan/ton, a year-on-year decrease of 44 yuan/ton; At present, the profit of welded pipe industry is at a low level in recent three years.

Since the beginning of the year, all parts of the country have actively accelerated the construction of major projects to help the economy “get off to a good start”. In the first quarter, with the end of epidemic prevention and control, the market expectation was improving, and the prices of raw materials and finished products were running firmly. Driven by “strong expectations”, welded pipe and galvanized pipe factories had a strong willingness to support prices, and the increase was higher than that of strip steel, and the profits were acceptable. However, with the end of March, the expected demand has not been released. As the heat fades and the negative news of international finance is superimposed, the strong expectation returns to reality, and the prices of pipe factories and traders begin to fall under pressure. In June, the profit of welded pipe industry has been at a low level in the past three years, and it is expected that the possibility of continuing to fall sharply is low.

Figure 3: Social Inventory of Welded Pipe (Unit: 10,000 tons)

Figure 4: Profit change of galvanized pipe in recent years (unit: yuan/ton)

Data source: Steel Union Data

IV. Output and Inventory of Welded Pipe Production Enterprises

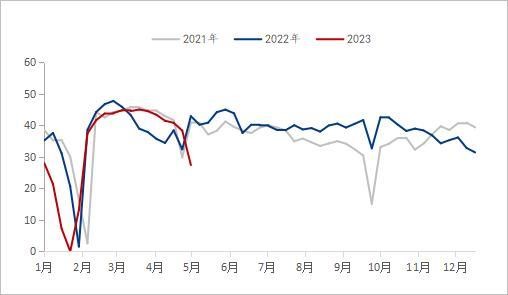

Judging from the output and inventory of welded pipe manufacturers, from January to May this year, the overall output of the pipe factory decreased significantly year-on-year, and the capacity utilization rate remained at 60.2%. Under the low capacity utilization rate year-on-year, the inventory of the pipe factory was always higher than that of the same period last year. As of June 2, 2023, according to the tracking statistics of 29 welded pipe manufacturers in our network, the total output of welded pipes from January to May was 7.64 million tons, a year-on-year decrease of 582,200 tons or 7.08%. At present, the inventory of welded pipe factory is 81.51 tons, a year-on-year decrease of 34,900 tons.

In recent two years, affected by the pressure of global economic recession, shrinking domestic downstream demand and many other aspects, the overall welded pipe output of domestic mainstream pipe factories has maintained a low level. At the beginning of the new year, in order to avoid the risks brought by price fluctuations, the overall capacity utilization rate of welded pipe manufacturers was on the low side from January to May. Although the output of the pipe factory began to increase obviously with the increase of the profit of the pipe factory in February, even exceeding the same period of last year, the output of the pipe factory began to decline rapidly at the end of March when the profit of the pipe factory fell rapidly. At present, the logic of supply and demand of welded pipes is still in a weak pattern of supply and demand.

Figure 5: Change of welded pipe output of 29 domestic mainstream pipe factories (unit: 10,000 tons)

Data source: Steel Union Data

Figure 6: Changes in finished product inventory of 29 mainstream pipe factories (unit: 10,000 tons)

Data source: Steel Union Data

V. Downstream situation of welded pipe

From the perspective of the real estate market, the real estate market has been in a downturn in recent years, and the demand for housing is insufficient From January to April, the national real estate development investment was 3,551.4 billion yuan, down 6.2% year-on-year; Among them, residential investment was 2,707.2 billion yuan, down 4.9%. In the past two years, various localities have successively issued various policies to promote the recovery of the real estate market, for example, relaxing the loan ratio, the amount of provident fund and the qualification for buying houses. By the end of the first quarter, 96 cities met the conditions of relaxing the lower limit of the first home loan interest rate, among which 83 cities lowered the lower limit of the first home loan interest rate and 12 cities directly cancelled the lower limit of the first home loan interest rate. After May Day, many places continue to adjust the provident fund loan policy. This year, the main tone of the central bank’s policy on the real estate market is “to manage both cold and hot”, which not only supports cities facing great difficulties in the real estate market to make full use of the policy toolbox, but also requires cities with rising housing prices to withdraw from the support policy in time. With the implementation of various policies, it is expected that the general trend of real estate market recovery will remain unchanged this year, but the overall recovery rate will be slow.

Judging from the growth rate of infrastructure investment, according to the data released by the National Bureau of Statistics, from January to April, the national infrastructure investment (excluding electricity, heat, gas and water production and supply industries) increased by 8.5% year-on-year. Among them, investment in railway transportation increased by 14.0%, water conservancy management by 10.7%, road transportation by 5.8% and public facilities management by 4.7%. With the overweight of counter-cyclical regulation and control policies, infrastructure construction is expected to play a supporting role.

In April, the purchasing managers’ index (PMI) of manufacturing industry was 49.2%, down 2.7 percentage points from last month, lower than the critical point, and the prosperity level of manufacturing industry declined, falling to the contraction range for the first time since February. In terms of industries, the business activity index of construction industry was 63.9%, down 1.7 percentage points from last month. The index of manufacturing production and demand declined, mainly due to insufficient market demand. Although the business activity index of the construction industry decreased slightly in April compared with the previous month, the PMI of the construction industry was above 60% for three consecutive months, which still maintained a high prosperity level. The construction industry is expected to improve, but the recovery of production and demand in the industry still needs to be gradually restored.

VI. Market Outlook

Cost: In June, with the tenth round of coke price increase, the market sentiment further cooled down. At present, the overall performance of coke and iron ore fundamentals is still in a situation of strong supply and weak supply, while steel mills have poor expectations for future demand, so resumption of production will not become the mainstream in the short term, and pressure will still be given to raw materials. From late May to early June, it is a high temperature weather in the south. With the increase of residential electricity demand and the superposition of power plants to prepare coal for summer, the coal demand will have an inflection point, but it will also lead to a drop in iron ore prices. In the short term, with the weakening of cost support, strip steel prices may continue to weaken.

Supply situation: At the beginning of June, the operating rate of welded pipe production enterprises decreased significantly compared with last year, and the inventory of pipe factories continued to decrease. In the near future, the inventory pressure of the pipe factory is not big, and the output of the pipe factory will increase after the profit of the pipe factory is obviously repaired.

Demand: On the basis of deepening the pilot project and summarizing and popularizing the replicable experience, China will start the lifeline safety project of urban infrastructure in an all-round way. It is necessary to carry out a general survey of urban infrastructure, establish a database of urban infrastructure covering the ground and underground, identify the risk sources and risk points of urban infrastructure, and compile a list of urban safety risks. The lifeline of urban infrastructure refers to urban infrastructure such as gas, bridges, water supply, drainage, heat supply and utility tunnel, which are inseparable from urban functions and people’s lives. Just like the “nerves” and “blood vessels” of human body, it is the guarantee of safe operation of cities.

VII. Summary

Overall, in the first quarter, under better macro expectations, the price of welded pipes was slightly supported. From April to May, the fundamental performance of coal char and iron ore was strong and weak, and the cost support was weakened. Although infrastructure investment is picking up, the general trend of market recovery in the real estate industry remains unchanged this year, but the overall recovery speed is slow. With the start of the lifeline safety project of urban infrastructure, the demand for steel pipes may increase in the near future, but the balance between supply and demand will still take some time. Coupled with the Fed’s high interest rate policy, the banking crisis continues to ferment, and the global risk premium will rise sharply, which will aggravate the volatility of commodity markets and may affect China’s exports. On the whole, it is expected that the national welded pipe price will still stop falling and stabilize from June to July.

Post time: Jul-28-2023